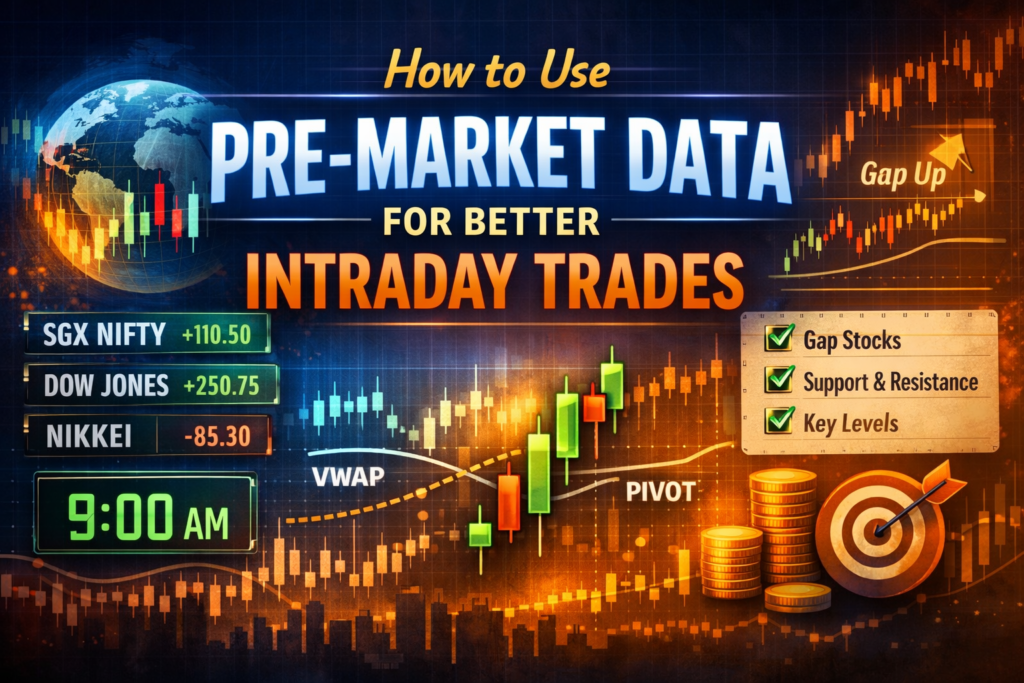

In this blog post, you’ll learn how to use pre-market data for better intraday trades, why it matters, and how to use it step-by-step for better intraday trades.

Pre-market data is one of the most powerful yet underused tools in intraday trading. Many traders jump into trades after market open without understanding what happened before 9:15 AM, which often leads to false entries, emotional trades, and losses.

Professional traders always start their day by analyzing pre-market data because it provides clarity about market sentiment, key levels, and possible intraday direction.

What Is Pre-Market Data?

Pre-market data refers to market activity before the regular trading session begins. In India, this includes:

•Pre-open session (9:00 AM – 9:15 AM)

•Global market movement (US, Asian markets)

•SGX Nifty / Gift Nifty movement

•Gap-up or gap-down indications

•Early volume and price behavior

This data helps traders prepare a trading plan before the market opens instead of reacting emotionally after the bell.

Why Pre-Market Data Is Important for Intraday Trading

Here’s why pre-market analysis gives you an edge: (best analysing apps in India)

1. Identifies Market Sentiment

You can know whether the market is:

•Bullish

•Bearish

•Range-bound

2. Shows Gap-Up and Gap-Down Stocks

Gap stocks often give high volatility, which is ideal for intraday traders.

3. Helps Mark Key Support & Resistance

Pre-market highs, lows, and close levels act as important intraday levels.

4. Avoids Random Trades

A clear pre-market plan reduces overtrading and emotional decisions.

Key Pre-Market Data You Must Analyze Daily

1. Global Market Cues

•Check:

•Dow Jones

•Nasdaq

•S&P 500

•Asian markets (Nikkei, Hang Seng)

Impact:

Strong global markets often lead to gap-ups; weak markets indicate gap-downs.

2. Gift Nifty / SGX Nifty

Gift Nifty gives an early indication of Nifty’s opening direction.

•Gift Nifty up → Positive opening expected

•Gift Nifty down → Negative opening expected

This helps you decide bullish or bearish bias before market open.

3. Pre-Open Market Data (9:00 – 9:15 AM)

During the pre-open session, observe:

•Opening price

•Pre-open high & low

•Volume buildup

These levels often act as breakout or rejection zones after 9:15 AM.

4. Gap-Up and Gap-Down Stocks List

Focus on stocks with:

•Strong news

•High volume

•Clear gap (1% or more)

Best intraday opportunities usually come from gap stocks.

5. Previous Day High, Low & Close

Mark these levels on your chart:

•Previous day high

•Previous day low

•Previous day close

They act as strong intraday support and resistance.

How to Use Pre-Market Data Step by Step

Step 1: Identify Market Bias

Before 9:15 AM, decide:

•Bullish day

•Bearish day

•Range-bound day

This decides whether you’ll focus on:

•Buy-on-dip

•Sell-on-rise

•Breakout or scalping

Step 2: Mark Important Levels on Chart

Mark:

•Pre-market high

•Pre-market low

•Previous day levels

•Pivot points (if you use them)

These levels guide entry, stop-loss, and target.

Step 3: Wait for Confirmation After Market Open

Never trade immediately at 9:15 AM.

Wait for:

•5-minute candle close

•Volume confirmation

•VWAP direction

Pre-market data gives direction, confirmation gives entry.( Learn how to use pre market data for better intraday trades.)

Step 4: Combine Pre-Market Data with Indicators

Best combinations: ( Vwap+ RSI trading strategy)

•Pre-market high + VWAP breakout

•Gap-up stock + RSI strength

•Pre-market low + bearish MACD crossover

This increases accuracy and reduces false signals.

Example of Pre-Market Data Usage (Practical)

Scenario:

•Gift Nifty is positive

•Stock opens gap-up

•Pre-market high is ₹520

Trade Plan:

•Buy above ₹520

•Stop-loss below VWAP

•Target using pivot resistance

This structured approach avoids guesswork.

Common Mistakes Traders Make with Pre-Market Data

❌ Trading without confirmation

❌ Ignoring volume

❌ Overtrading gap stocks

❌ Using pre-market data alone without indicators

Remember: Pre-market data is a guide, not a signal by itself.

Best Tools to Check Pre-Market Data

•NSE India website

•TradingView

•Zerodha Kite

•Investing.com

•Moneycontrol

(Use reliable and fast platforms for accurate data.

📈 Trade Safely with a Trusted Broker

Risk management works best when you trade on a fast & reliable platform.

I personally recommend Zerodha for beginners and active traders because of:

✔ Low brokerage

✔ Fast order execution

✔ Powerful tools like Kite & Coin

👉 Open your Zerodha account here)

Final Thoughts

Using pre-market data correctly can completely transform your intraday trading performance. It helps you trade with:

•Clear direction

•Better risk management

•Higher confidence

If this blog makes sense to you give your feedback in comments and stay tuned.

At the end of the day

Trading isn’t about timing in the market it’s about time in the market.

Downloaded the Jilibetsigninapp. So far, so good. Fast and easy to log in. Now to the real test, the games! Let’s play! Download now: jilibetsigninapp

товары для праздника и подарков магазин One Price https://oneprice.shop/

http://google.com.lb/url?q=http://oneprice.shop