In this blog you will learn about top 5 scalping strategies for beginners, in simple words and beginners friendly stay tuned for more updates.

Best scalping strategy

What is scalping?

→ Scalping is a very short term trading style where trades aim to make many small profits throughout the day – instead of waiting for one big move.

In simple words:

Scalping means buying and selling quickly to capture small price movements.

Example:

- A traded buys bank nifty at rs 48,000.

- Price moves to Rs 48,050- he books RS 50.

- He repeats this many times a day.

Even if each trade gives a small gain , 10-15 successful scalps can make good profit by the end .

Holding time

- Usually 30 seconds to 5 minutes.

- Scalpers close all trades before market closing.

Time frame scalpers use.

- 1- min or 3- min chart

Goal of scalping

- Take advantage of small but frequent price changes .

- Focus on accuracy and speed , not big trend moves.

Scalping requires

- Fast internet & low brokerage charges.

- Quick decision – making

- Discipline

Best scalping strategies

- Vwap pullback strategy

Best for: Nifty/ banknifty or liquid stocks

Indicator: Vwap

Vwap pullback strategy

- Wait for the price to move above Vwap → the trend is bullish.

- When the price pulls back near Vwap, look for a bullish candle – buy.

- For bearish setup, Price below Vwap → pullback near Vwap → sell

Exit:

- Target 0.3% – 05% or 1:1.5 risk – reward.

- Stop loss : below/ above Vwap line.

Why it works: Vwap acts as a strong intraday support/ resistance. Institutions use it.

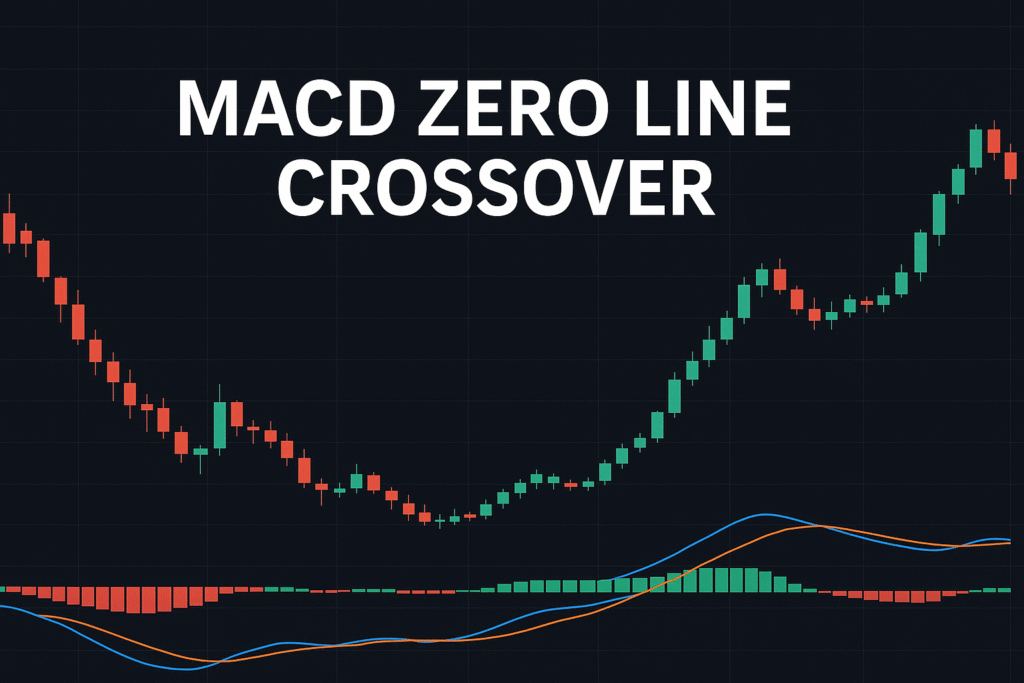

2. Macd zero – line crossover

Best for: 5- min and 15- min charts indicator: Macd

Macd zero line crossover

Setup

- When Macd crosses above 0 line → market gaining momentum → buy

- When Macd crosses below 0 line → weakness → sell

Exit

- Exit when Macd histogram starts weakening or cross in the opposite direction.

Why it works: it filters fake signals and shows the true shifts in intraday trend

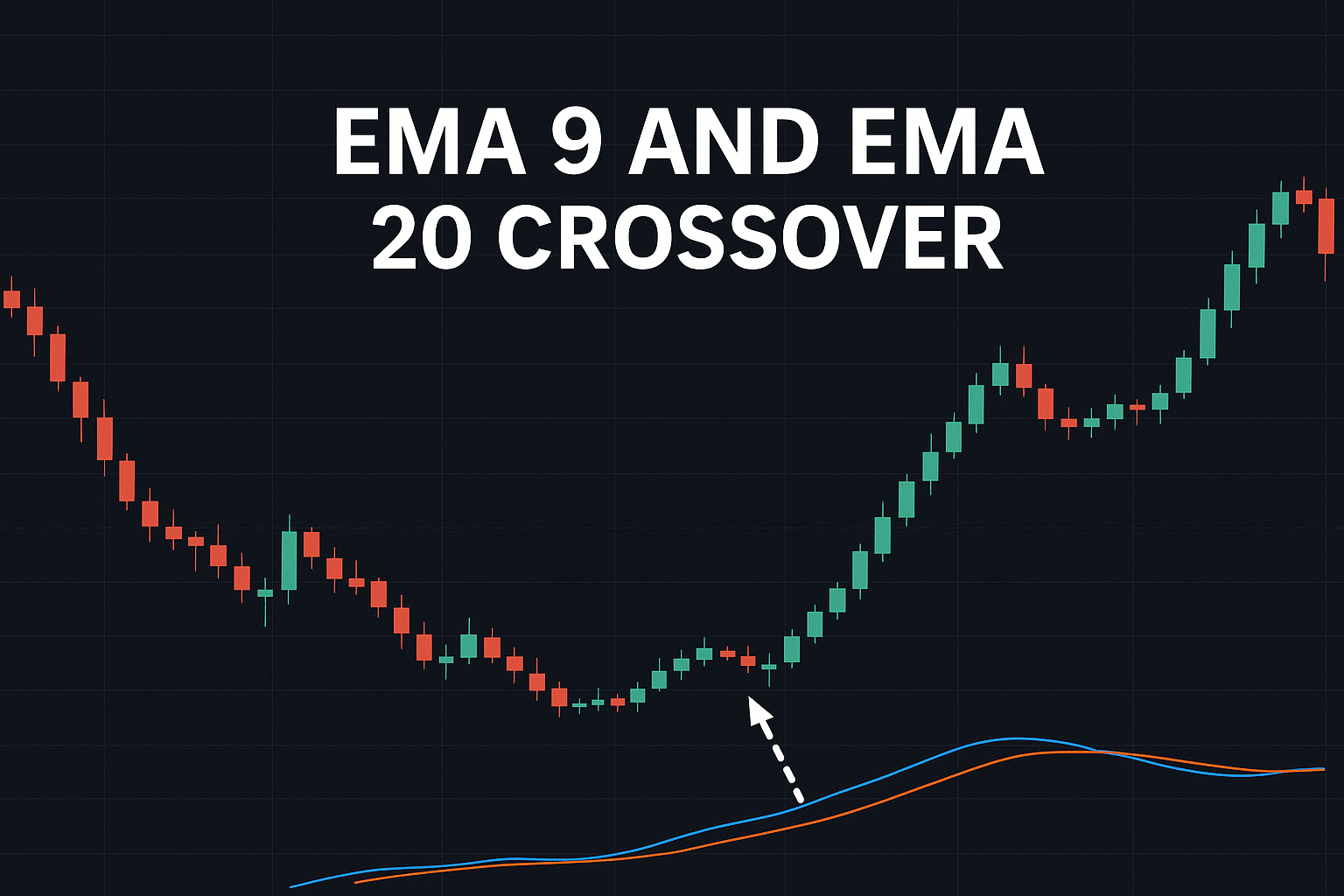

3. Ema 9 and Ema 20 crossover best for: stocks and Index scalping.

Indicators : Ema 9 and Ema 20 setup

- When Ema 9 crosses above Ema 20 → buy .

- When Ema 9 crosses below Ema 20 → Sell.

Exit

- Take profit when the candle closes from Ema lines or crossover reverses.

4. Breakout+ Retest Strategy.

Best for: Banknifty nifty, nifty or momentum stocks.

Price action strategy

- Draw support and resistance zones for previous highs/ lows.

- When prices break resistance → wait for a small retest → enter after confirmation candle.

- Reverse for breakdowns.

Exit:

- Target 0.5% to 1% or nest pivot levels

- Stop loss below the retest candle.

Why it works: confirm strength after breakout – filters fake moves.

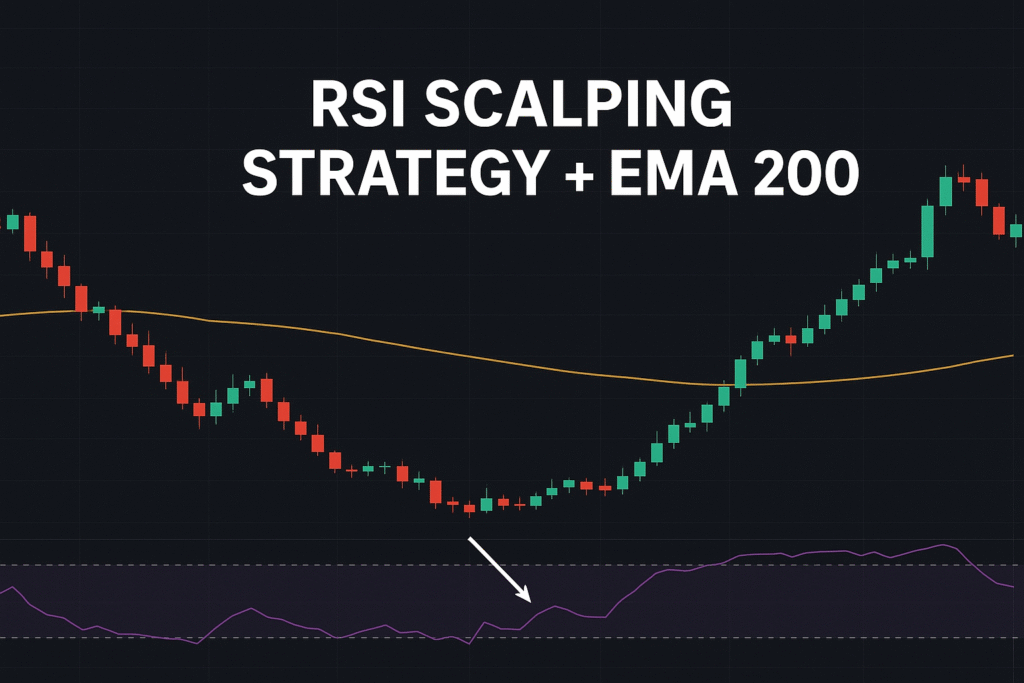

5. RSI scalping strategy+ Ema.

Best for: quick scalps

- Only take buy trades above Ema 200, sell trades below Ema 200

- RSI between 60-40 zone – wait for RSI bounce from 40 or rejection from 60.

Exit

- Target 0.3%- 0.7%

- Stop loss below the last candle or fixed points .

Why it works: combines strength with momentum.

→ Bonus strategy for Scalping

Vwap+ Macd

You use Vwap to confirm the trend direction , and Macd to confirm the momentum before entering a trade.

Together, they give trend+ strength= high accuracy

Setup Indicators= Vwap (default)

Macd = 12,26,9

Time frame: 1-min or 3- min chart

Asset : Bank nifty , Nifty or any highly liquid stock.

→ buy setup

- Price above Vwap → trend is bullish.

- Macd line crosses above signal line → Momentum turning positive.

- Entry: On candle close after Macd crossover.

- Stop loss : below Vwap or previous candle low.

- Target: 0.4%- 0.7% or 1:2 risk reward ratio

Example

→ If banknifty= 49,000

→ Stoploss 40 pts target 80 pts

Sell setup

- Price below Vwap → Trend is bearish

- Macd line crosses below signal line momentum turning negative.

- Entry: On candle close after Macd crossover

- Stoploss: Above Vwap or previous candle high.

- Target: 0.4% – 0.7%

Why this work

- Vwap= institutional trend filter

- Macd= confirm momentum direction

- You trade only when both trend and momentum agree.

- This filters out 70-80% of false signals.

→ Live market guide

- Choose the right time

- Best time 9:20 Am – 11:00 Am and 1:45 pm -3:00 pm

- Avoid 9:15-9:20 and launch time.

- Set up your chart

- Time frame: 1- min or 3- min

- Indicator = Vwap+ Macd

- Read the trend using vwap

- Price above Vwap → bullish trend

- Price below Vwap → bearish trend

- This tells you which direction to focus on – don’t trade against Vwap.

- Wait for Macd confirmation

- For buy trade

- Macd line crosses above the signal line

- Crossover happens above zero line= stronger signal.

- For sell trade

- Macd line crosses below the signal line.

- Crossover happens below zero line stronger signal.

- For buy trade

- Entry point

- Buy entry: when candles close above Vwap and Macd crossover confirms.

- Sell entry: When the candle closes below Vwap and Macd crossover confirms .

- Enter the next candle after confirmation to avoid fake signals.

- Stop loss and target

- Stoploss

- For buy → below Vwap or previous candle low

- For sell → above Vwap or previous candle high .

- Target

- Small but quick= 0.4%- 07% or 1:2 risk reward ratio.

- For banknifty options, 20-40 points per scalp is ideal.

- Stoploss

- Exit signals.

- When Macd starts to flatten or crossover in the opposite direction.

- Candle close opposite to Vwap direction.

- Or your profit target hits.

- Repeat only in trending markets.

- If price keeps bouncing around Vwap, skip trades → it means the market is sideways and scalping accuracy drops sharply. Live market example:

- Price stays above Vwap after 9:30→ bullish signal.

- Macd crosses up near 9:45→ buy signal.

- Entry above the candle high after confirmation.

- Exit with+40 points gain within 5 minutes.

- If price keeps bouncing around Vwap, skip trades → it means the market is sideways and scalping accuracy drops sharply. Live market example:

Common mistakes to avoid

- Taking trades before confirmation.

- Trading when the price is exactly on Vwap.

- Holding scalpers too long – always book profits fast.

- Ignoring volume.

→ Conclusion

The Vwap+ macd scalping strategy is one of the most powerful and beginners – friendly setups for intraday and options traders.

It combines two key confirmation

- Vwap → Institutional trend direction

- Macd → Momentum and strength of move

How scalping is different from intraday trading.

- Holding time

- Scalping – very short few seconds to few minutes.

- Intraday – longer from a few minutes to a few hours.

- Goal

- Scalping – Capture small price movements many times a day.

- Intraday – Capture a bigger intraday trend once or twice a day.

- Trades per day

- Scalping- 10-50 trades

- Intraday – 1-5 trades

- Profit per trade

- Scalping – small 0.2%-0.7%

- Intraday – large 0.8%-3%.

- Stop loss

- Scalping – very tight.

- Intraday – wider stoploss.

- Charts used

- Scalping – 1-min or 3-min chart.

- Intraday – 5-min or 15-min charts.

- Traders focus

- Scalping – speed quick reaction volume

- Intraday – trend breakout technical confirmation.

- Risk level

- Scalping – high

- Intraday – moderate

→ Intraday Trading= fewer trades, bigger moves , more patience.

→ Scalping= quick profits , small target high activity.

- Avoid trades when the price is flat around Vwap.

- Take trades after 9:20 Am when volume stabilizes.

- Stop trading after 2-4 continuously wins or losses.

- Combine with volume confirmation for even higher accuracy.

If this strategy makes sense to you give your feedback in comments.

In the next blog I will share about the macd+ Vwap combo strategy for better accuracy stay tuned.

At the end of the day

–trading isn’t about timing in the market it’s about time in the market.

- What is price action analysis?In this guide, you will learn,What is price action analysis,How it works,Important concepts,Best strategies for beginners. Introduction Price Action Analysis is one of the most… Read more: What is price action analysis?

- Importance of consistency and discipline in tradingIn this blog you will learn about the importance of consistency and discipline in trading, in simple words and beginners friendly. In the stock market,… Read more: Importance of consistency and discipline in trading

- How to start intraday trading In India with small capitalIn this blog you will learn about how to start intraday trading in India with small capital, simple words and beginners friendly stay tuned for… Read more: How to start intraday trading In India with small capital

- What is technical analysis in the stock marketIn this guide you will learn about what is technical analysis in the stock market, in simple words and beginners friendly. If you want to… Read more: What is technical analysis in the stock market

- What is Support and Resistance & Supply and Demand in stock marketIn this blog you will learn about, what is support and resistance & supply and demand in stock market,stay tuned for more information. If you… Read more: What is Support and Resistance & Supply and Demand in stock market